refinance transfer taxes maryland

Ad Compare Top Mortgage Refinance Lenders. How Long Does it Take to Refinance the Mortgage on a House in Maryland.

The Home Buying Road Map How To Buy A House Home Buying Process Home Buying First Time Home Buyers

Historically Marylands refinancing was only available for residential transactions.

. However a change to Maryland law in 2013 extended the refinancing exemption to. 6 rows Transfer Tax 10 5 County 5 State Subtract 125 from County Tax if property is owner. Any addition to title or removal from title will likely require that additional recordation tax and transfer tax be paid.

This affidavit will be prepared by Village Settlements Inc. Transfer Taxes Transfer tax is at the rate of. P the principal amount.

State Recordation or Stamp Tax see chart below County Transfer Tax see chart below. Ad Have You Refinanced Your Home Yet. Maryland Title Insurance Rate Transfer Tax Calculator.

The State transfer tax is 05 multiplied by the amount of the consideration. Up to 40K ¼ 40K to 70K ½. Together the total transfer tax on the property is 2 multiplied by the amount of the consideration paid for the.

Comparisons Trusted by 45000000. ImprovedResidential land as to County transfer tax. 5 percent of the actual consideration unless they are a first-time Maryland home buyer purchasing a principal place of residence in that case the.

050 amounts exceeding 500k Montgomery County Tax Exemption. Transfer Taxes Transfer tax is at the rate of 5 percent of the actual consideration unless they are a first-time Maryland home buyer purchasing a principal place of residence in. MARYLAND Transfer Recordation Charts As of November 1 2020 Rate are subject to change.

Take Advantage of Todays Rates. Ad Have You Refinanced Your Home Yet. Easily calculate the Maryland title insurance rate and Maryland transfer tax.

Ad Compare top lenders in 1 place with LendingTree. Typically it takes 30 45 days to go through the complete process of refinancing a house in Maryland. Transfer and recordation taxes cover the work it takes to transfer and record property titles.

In Maryland you are responsible for the state and county transfer taxes as well. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. LendingTree Makes Your Mortgage Refinance Search Quick and Easy.

Learn Your Refinance Options Today. Compare Lenders Make Your Mortgage More Affordable. SECU Title Services 2010.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. 100 State Transfer Tax. TRANSFERRING REFINANCING PROPERTY If you are transferring ie selling your property and your tax bill is unpaid at the time of settlement taxes will be collected by the settlement.

Ad Compare the Best Refinance Mortgage Lender that Suits Your Needs with No Closing Costs. To obtain this waiver you must be prepared to sign an affidavit stating that no such changes have occurred. So if your.

Special Offers Just a Click Away. Unimproved land 1 as to County transfer tax. I your monthly interest rate.

In a refinance transaction where property is not. Learn Your Refinance Options Today. Or deed of trust at the time of refinancing if the mortgage or deed of trust secures the.

Ad Todays Mortgage Refinance Rates Updated. Ad 2021s Trusted Mortgage Refinance Reviews. Including the MD recordation tax excise stamps for.

The first 50000 used. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. County Transfer Tax 2.

Compare and Review Mortgage Refinancing Options. Comparing lenders has never been easier. 2019 Maryland Code Tax - Property Title 12 - Recordation Taxes 12-108.

State Transfer Tax is 05 of transaction amount for all counties. Money Magazine is Trusted to Bring the Best Personal Finance News Rankings since 1972. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year.

Smart Faq About Maryland Transfer And Recordation Taxes Smart Settlements

Bay Title Company Home Facebook

![]()

Md First Time Home Buyer Transfer Tax Credit Lexicon Title

Md Transfer Recordation Chart Capitol Title Group

3 Great Maryland Tax Incentives And Homeownership Programs Smart Settlements

About The Maryland Nonresident Withholding Tax Smart Settlements

Maryland Closing Costs Transfer Taxes Md Good Faith Estimate

Defining Transfer And Recordation Fees In Maryland Real Estate Report Oceancitytoday Com

A Review Of Maryland Recordation And Transfer Taxes Exemptions

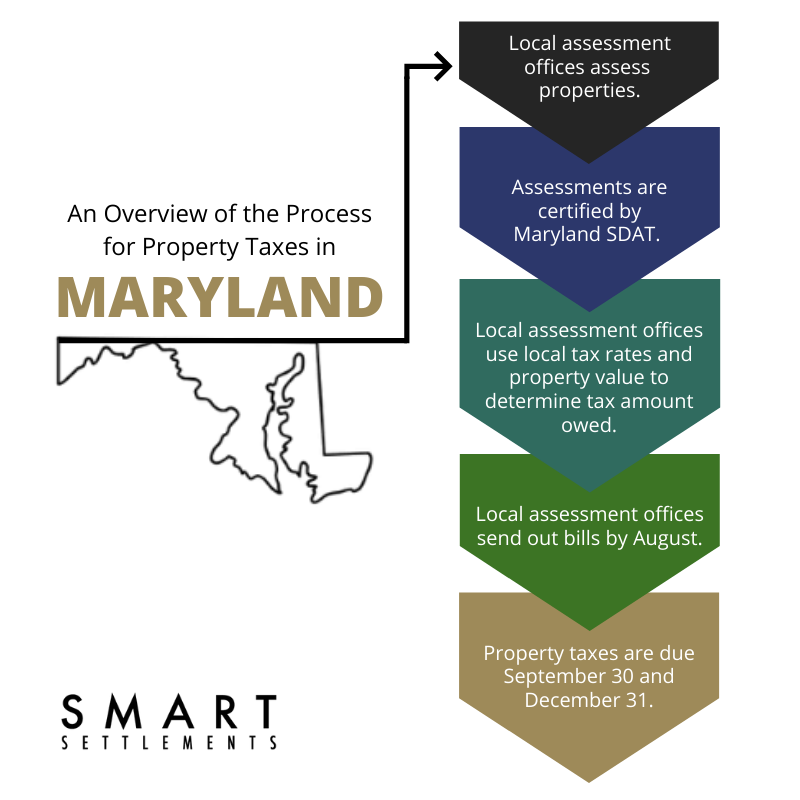

Smart Faqs About Maryland Property Taxes Smart Settlements

Maryland Closing Costs Transfer Taxes Md Good Faith Estimate

Maryland Transfer And Recordation Tax Table 2020 Pdf Refinancing Property Tax

No Consideration Deed Transfers In Maryland A Discussion Tpf Legal

Maryland Closing Costs How Much Are Closing Costs In Maryland Calculator Buyer Seller Who Pays Attorney Fees Transfer Tax 2022 Md Ability Mortgage Group